How To Analyze Trading Volume For Market Opportunities

How to analyze the volume of trade by market capabilities cryptocurrency

The cryptocurrency world has exhausted explosive growth over the years, and many new and established coins are recorded in record. However, one main factor that can affect the cost of the coin is its volume of trade. Understanding how to analyze the volume of trade, it is very important to create information about information on this rapidly developing market.

** What is the volume of trade?

The volume of trade refers to the total volume of trade units.

** Why is the volume of trade important?

The volume of trade is necessary for several reasons:

- Price discovery

: Large trade volumes can show great interest

2.

;

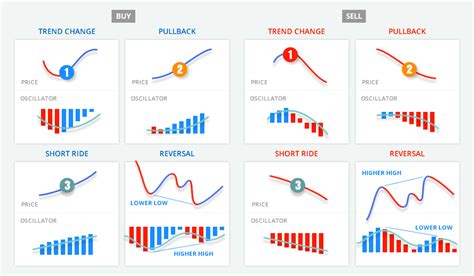

How to analyze the volume of trade

To effectively analyze the volume of trade, do the following:

1

; Real time data.

*

- Find trends and correlations : Set positive or negative trading trends and investigate how they correlate with price changes.

Basic Metrics of Trade Volume for tracking

Here are some of the main metrics that need to be considered when analyzing the volume of trade:

1

- 24 -hour volume : total number of transactions performed within 24 hours.

3.

- monthly volume : total number of goods per month.

interpretation of trading volume data

Remember when interpreting trading volume data:

1

;

;

Example Usage Case: Bitcoin Trade Examination Analysis

For example, let’s analyze the Bitcoin (BTC) trade volume in the last 30 days:

- The average daily trade volume (ADTV): 2.5 million.

- 24 -hour volume: $ 10 billion

- Week volume: 1 billion

- Monthly volume: $ 20 billion

Based on these data, we can conclude:

*

;

- The small volume of 24 hours can mean reduced confidence or fear in the market.

Conclusion

Trade volume analysis is an essential step in understanding the dynamics of cryptocurrency markets.